Market Corrections are not unusual.

A bull market is defined as one that achieves a return greater than 20%, conversely a bear market is one that declines over 20%. Market corrections are ones where the decline is greater than 10%, but does not exceed 20%. The market's recent decline from its April high was -12.3%, thus qualifying it as a correction. Corrections do not necessarily lead to bear markets though.

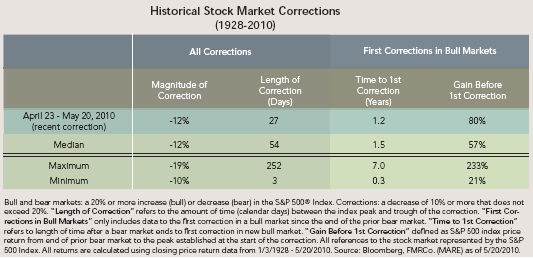

It’s been about 14 months since the current bull market began on March 9, 2009, which is in the neighborhood of the average length of time that has passed from the start of prior bull markets to a first correction (17 months, see above table, click on it to see the full table).

The stock market gained 80% before the recent correction. Historically, the first correction in a new bull market has come after average gains of 57%, implying the current bull market was overdue for a correction on a price appreciation basis.

The main factor that has differentiated this recent correction is that it has taken place at a fairly swift pace compared to history. It took 27 days for the market to surpass the 10% decline threshold, which is half the time it’s historically taken on average for a correction to occur (54 days).

Since 1926, there have been 20 stock market corrections during bull markets, meaning 20 times the market declined 10% but did not subsequently fall into bear market territory. Whether the market recovers again from here and avoids a bear market remains to be seen, but at the very least the more surprising development based on historical patterns would have been a continued bull market rally without a 10% pause.

In the short term, the S&P 500 index has bounced 2% off the May 26 low of 1,067. A number of equities are now trading at attractive valuations; maybe giving investors an opportunity to pick up some decent companies at attractive prices/valuations.

Source: Fidelity Investments Research.

It is something to keep our spirits positive. Haha.

Best,

SVI